Credit scores are designed to help lenders understand how likely they are to repay borrowed money. Credit-scoring companies apply a mathematical formula to data about how you’ve handled credit in the past — and that data comes from your credit reports.

You have a right to see your credit reports, and taking a look at them is a key part of working on your credit. It lets you verify that the information is accurate and timely, and also gives you an idea of how potential lenders or even employers might view you.

Here’s what to know about your credit reports and how to get them.

What’s a credit report?

A credit report is a record of your credit accounts and how you’ve paid them, plus information to establish your identity.

When you use credit, or simply apply for it, that information can go into files maintained by the three major credit-reporting agencies: Equifax, Experian and TransUnion. Lenders and credit card issuers can report to one, two, or all three credit bureaus. The bureaus collect that data, plus some identifying information and sometimes debt information from public records. It’s strictly factual information, with no interpretation.

Your reports typically vary a bit between credit bureaus, because reporting is voluntary, and not every creditor reports to every credit-reporting agency. If you have no experience with credit, you shouldn’t have a credit report. (If you do, it suggests identity theft.)

Your credit report information may be shared, with your permission, when you apply for credit, a job, a rental, or utilities. Lenders and credit card issuers typically check your credit to decide whether to approve your application and on what terms.

What’s the difference between a credit score and a credit report?

A credit report isn’t the same as a credit score, and reports don’t include your score.

Credit bureaus sell credit report access to credit-scoring companies, who run some of the data through proprietary formulas to produce credit scores.

So, a credit score is a number designed to help a lender or card issuer gauge the risk involved in lending to you, while a credit report contains the data used to calculate that number. And because credit bureaus don’t have exactly the same data, you’re likely to have slightly different scores depending on which set of data was used in the calculation.

You may have credit report access already

If you’ve checked your free credit score, you may also have access to a credit report. It will be an abbreviated version of your full credit report, and it will come from the same credit bureau as your free score. You can use that information to stay on top of your payment history, credit utilization, recent applications, and more, but it won’t be as detailed as your full credit report, which will likely go back further in time and include a list of who’s viewed your report.

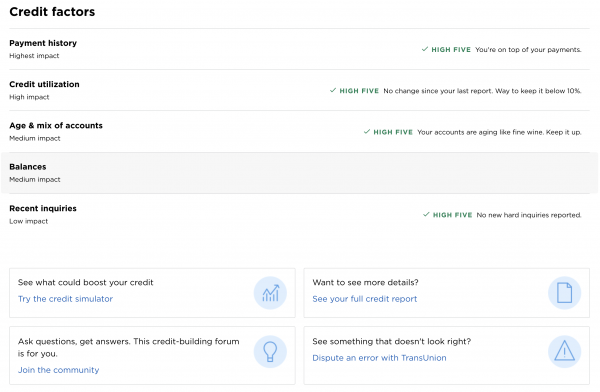

If you’ve signed up for a free score from NerdWallet, you’ll find your credit report information under “Credit factors” at the bottom right of NerdWallet’s credit score page. You can see details about your credit accounts, current balances, and payment history.

How to get all 3 free credit reports

The Fair and Accurate Credit Transactions Act gives consumers the right to see their credit report at no charge from each of the three major credit bureaus at least once a year. That information is available by using AnnualCreditReport.com. Credit bureaus are currently allowing weekly access through April because of the pandemic. Once you get a report, it’s smart to print it out or keep an electronic copy.

When requesting reports through that website, you’ll need to fill in your name, Social Security number, birth date, and address, including the four-digit suffix to your ZIP code. You’ll need to list your previous address if you’ve been at your current one less than two years.

After that, you’ll be asked questions to verify your identity. Each credit bureau has its own questions, so if you’re requesting all three credit reports, you’ll have three sets of questions. The questions can be hard, such as the county you lived in 30 years ago, which bank issued a card that was opened 10 years ago in a particular month, or the approximate amount of a car payment. Learning the basics of corporate taxes can help you land a job in private or public accounting. Become proficient in corporate tax preparation and filing to increase your job prospects.

If you have a previous credit report, you may want to refer to it to help answer questions. However, you may get a question that can’t be answered by referencing old reports, says Shaundra Turner Jones, director, corporate affairs and communications at TransUnion. “We understand some may find it frustrating to go through the authentication process, but it’s essential to protect the privacy of your information,” she says.

If you’re unable to correctly answer, you’ll be given instructions for how to request your credit report by mail and what documentation will be required. You may also be able to verify by phone.

You’re likely to see offers for additional information or services, often at a cost, but your credit report itself is free. Just decline those offers and the site will let you complete your requests at no charge.

Need Help?

If you still need help with controlling your debt and/or improving your credit, fill out the form below and get a free credit consultation from a credit expert at Better Qualified.