Credit Freeze FAQs

What is a credit freeze?

Also known as a security freeze, this free tool lets you restrict access to your credit report, which in turn makes it more difficult for identity thieves to open new accounts in your name. That’s because most creditors need to see your credit report before they approve a new account. If they can’t see your report, they may not extend the credit.

Does a credit freeze affect my credit score?

No. A credit freeze does not affect your credit score.

A credit freeze also does not:

- Prevent you from getting your free annual credit report

- Keep you from opening a new account, applying for a job, renting an apartment, or buying insurance. But if you’re doing any of these, you’ll need to lift the freeze temporarily, either for a specific time or for a specific party, say, a potential landlord or employer. It’s free to lift the freeze and free to place it again when you’re done accessing your credit.

- Prevent a thief from making charges to your existing accounts. You still need to monitor all bank, credit card and insurance statements for fraudulent transactions.

Does a credit freeze stop prescreened credit offers?

No. If you want to stop getting prescreened offers of credit, call 888-5OPTOUT (888-567-8688) or go online. The phone number and website are operated by the nationwide credit bureaus. You can opt out for five years or permanently. However, some companies send offers that are not based on prescreening, and your federal opt-out right will not stop those kinds of solicitations.

As you consider opting out, you should know that prescreened offers can provide many benefits, especially if you are in the market for a credit card or insurance. Prescreened offers can help you learn about what’s available, compare costs, and find the best product for your needs. Because you are pre-selected to receive the offer, you can be turned down only under limited circumstances. The terms of prescreened offers also may be more favorable than those that are available to the general public. In fact, some credit card or insurance products may be available only through prescreened offers.

Can anyone see my credit report if it is frozen?

Certain entities still will have access to it. Your report can be released to your existing creditors or to debt collectors acting on their behalf. Government agencies may have access in response to a court or administrative order, a subpoena, or a search warrant.

How do I place a freeze on my credit reports?

Contact each of the nationwide credit bureaus:

Equifax

Equifax.com/personal/credit-report-services

800-685-1111

Experian

Experian.com/help

888-EXPERIAN (888-397-3742)

Transunion

TransUnion.com/credit-help

888-909-8872

You’ll need to supply your name, address, date of birth, Social Security number and other personal information. After receiving your freeze request, each credit bureau will provide you with a unique PIN (personal identification number) or password. Keep the PIN or password in a safe place. You will need it if you choose to lift the freeze.

How do I lift a freeze?

A freeze remains in place until you ask the credit bureau to temporarily lift it or remove it altogether. If the request is made online or by phone, a credit bureau must lift a freeze within one hour. If the request is made by mail, then the bureau must lift the freeze no later than three business days after getting your request.

If you opt for a temporary lift because you are applying for credit or a job, and you can find out which credit bureau the business will contact for your file, you can save some time by lifting the freeze only at that particular credit bureau. Otherwise, you need to make the request with all three credit bureaus.

What’s the difference between a credit freeze and a fraud alert?

A credit freeze locks down your credit. A fraud alert allows creditors to get a copy of your credit report as long as they take steps to verify your identity. For example, if you provide a telephone number, the business must call you to verify whether you are the person making the credit request. Fraud alerts may be effective at stopping someone from opening new credit accounts in your name, but they may not prevent the misuse of your existing accounts. You still need to monitor all bank, credit card and insurance statements for fraudulent transactions.

Three types of fraud alerts are available:

Fraud Alert. If you’re concerned about identity theft, but haven’t yet become a victim, this fraud alert will protect your credit from unverified access for one year. You may want to place a fraud alert on your file if your wallet, Social Security card, or other personal, financial or account information is lost or stolen.

Extended Fraud Alert. For victims of identity theft, an extended fraud alert will protect your credit for seven years.

Active Duty Military Alert. For those in the military who want to protect their credit while deployed, this fraud alert lasts for one year and can be renewed for the length of your deployment. The credit bureaus will also take you off their marketing lists for pre-screened credit card offers for two years, unless you ask them not to.

To place a fraud alert on your credit reports, contact one of the nationwide credit bureaus. A fraud alert is free. The credit bureau you contact must tell the other two, and all three will place an alert on their versions of your report.

Consider Freezing Your Credit:

Freezing your credit is a proactive step to protect your financial identity. It prevents new creditors from accessing your credit report, making it more difficult for identity thieves to open accounts in your name. To place a freeze, you need to contact each of the three major credit bureaus separately or use a service like CreditKarma:

Please know, that freezing your credit does not affect your credit score nor prevents you from getting your free annual credit report. You can lift the freeze temporarily using a PIN if you need to apply for credit or permanently when it suits your needs.

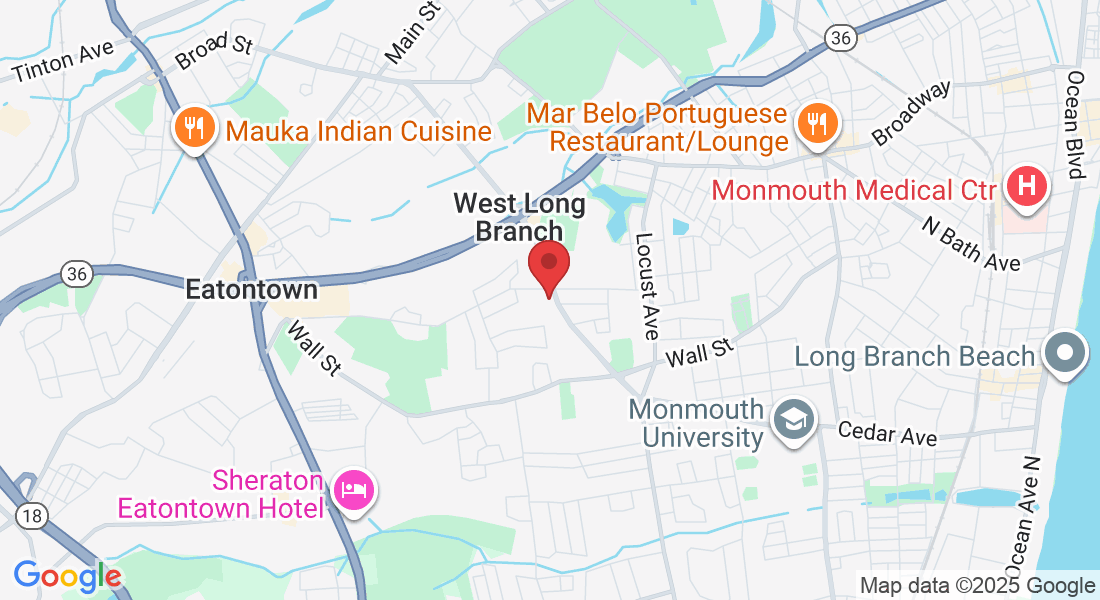

Contact Us

Phone: (732) 203-7377

Email: [email protected]

Office Address: 241 Monmouth Rd LL05, West Long Branch NJ 07764