Your credit score is one of the most important numbers in your financial life: A higher score makes it easier to qualify for better rates on installment loans and more rewarding credit cards and adds extra sparkle to your apartment application.

Conversely, a lower score can make your financial life more difficult: The loans and credit cards you will qualify for will likely be smaller and carry much higher rates and less favorable terms. And if your score is really poor, you might be denied access to loans you need altogether.

Grow mapped Experian’s data for all 50 states and the District of Columbia to show how Americans’ credit scores compare across state lines.

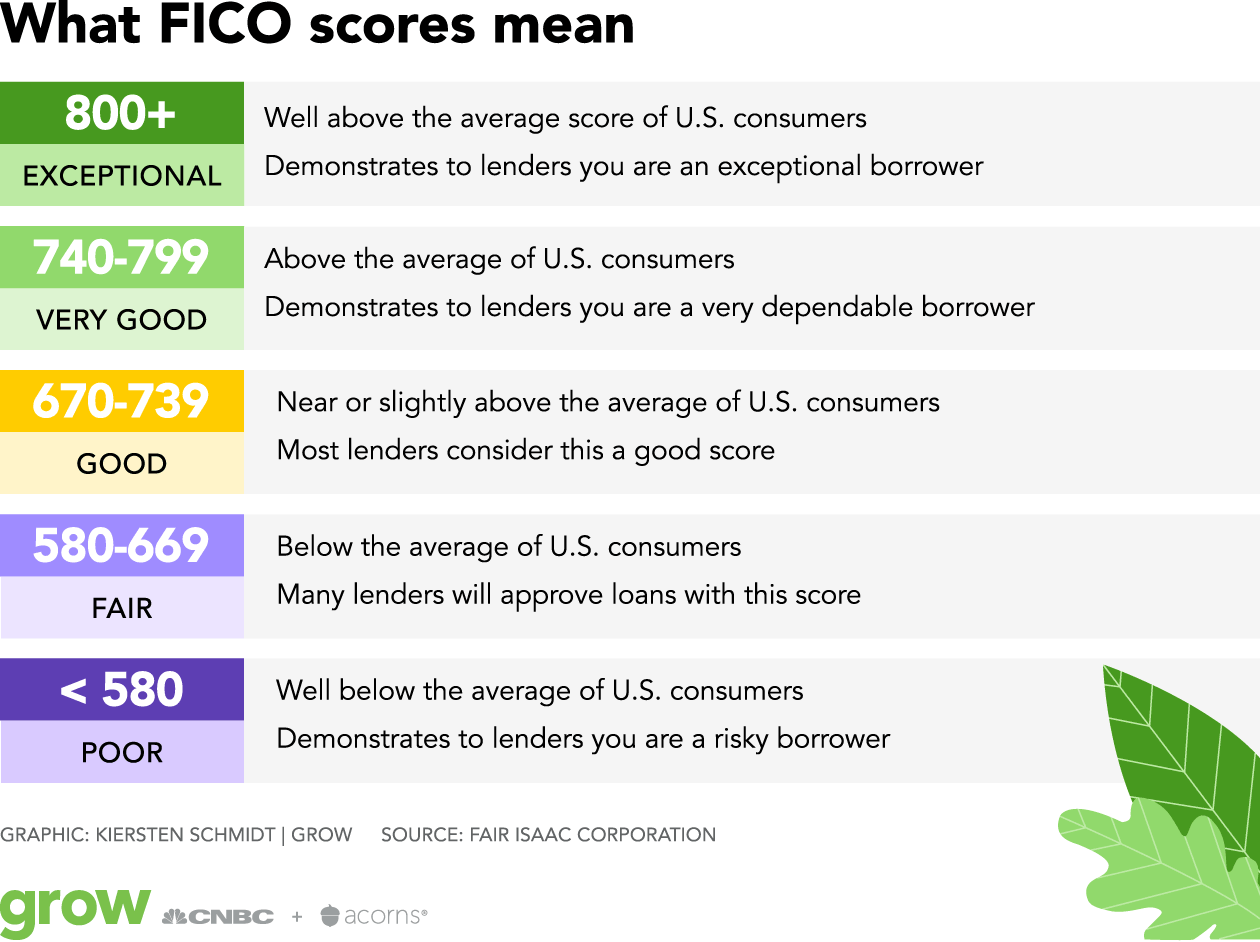

FICO credit scores range from very poor to exceptional

According to my friends at Crediful, your credit score is based on data in your credit report. There are several different scoring formulas, and some of the most widely used include FICO and VantageScore. Experian relies on the FICO model, which categorizes scores into five buckets, ranging from poor to exceptional.

Interestingly, the average credit score for every state falls in the “good” category, despite the 64 point spread between Minnesota’s 739 and Mississippi’s 675.

How to improve your credit score from ‘good’ to ‘great’

Every state’s average credit score lands in the “good” category, but you’ll likely need a “very good” score to secure the best terms for the loan you want. For example, experts say you’ll generally need a 740 to nab a great rewards credit card, and at least a 760 to get the best rate on a mortgage, which can save you tens of thousands of dollars over the life of the loan.

Video by Stephen Parkhurst

To improve your score, it helps to understand what goes into it. Your score is based on information in your credit report. Your payment history is the most influential factor, accounting for a little more than a third of your score.

“Credit scoring is all about how well you manage your money, not how much money you have,” Ted Rossman, an industry analyst at Bankrate, told Grow last year.

Payment

history

Utilization

Length of credit history

New credit

Credit mix

Here are three simple things you can do to improve your score:

- Improve your credit utilization. “The most impactful thing that consumers can do to quickly improve their credit score is to lower their credit utilization ratio,” Rossman told Grow. Your credit utilization ratio — that is, the amount of credit you’re currently using divided by the total amount of credit you have available — is second only to payment history when calculating your credit score. Keeping old cards open, paying down debt, and strategically using balance transfer offers can help improve this key ratio.

- Make payments on time. Late payments ding your score, so set up automatic payments or reminders to ensure you pay on time every month.

- Pay off your balance in full. This helps improve your credit utilization, especially if you tackle the balance before your statement closes. “Queer Eye” star Bobby Berk found that paying a few days early boosted his score by nearly 150 points because it looked like he was using less credit. “I watched my score go from the low 700s to 840 or 845,” Berk told Grow.

Need Help?

If you still need help with controlling your debt and/or improving your credit, fill out the form below and get a free credit consultation from a credit expert at Better Qualified