Credit Repair FAQs

What exactly is credit repair, and how does it work?

Credit repair is the process of identifying and disputing inaccurate, outdated, or unverifiable items on your credit report. Our team works on your behalf to challenge negative information with the credit bureaus and your creditors, aiming to improve your credit profile over time.

Is credit repair legal?

Yes, credit repair is 100% legal under federal law. The Fair Credit Reporting Act (FCRA) gives you the right to dispute items on your credit report and have inaccurate or unverifiable information removed. We simply help you exercise those rights more effectively and efficiently.

How long does the credit repair process take?

Every case is different, but most clients start seeing results within 30 to 90 days, with continued improvements over 3 to 6 months or more. The length of the process depends on your unique credit history and the number and complexity of items being disputed.

Will paying off my debts fix my credit?

Paying off debt can help over time, but it doesn’t automatically improve your credit scores — especially if negative items like late payments or charge-offs remain on your report. Credit repair helps by addressing the reporting of those items, not just the balance.

Can you remove accurate negative items from my credit report?

We do not remove accurate, verifiable information that’s reported fairly. However, many credit reports contain errors or outdated items — and we focus on correcting those. Any company that guarantees removal of accurate negative items is not acting legally or ethically.

How much does credit repair cost, and is it worth it?

Our pricing is transparent and affordable — and many clients find the long-term financial benefit (lower interest rates, better loan approvals, even job opportunities) far outweighs the cost. We’ll review your situation first to make sure credit repair is the right solution for you.

What happens after my credit improves?

We don’t just fix your credit — we also help you build it stronger. We’ll guide you on maintaining healthy credit habits, using credit responsibly, and monitoring your progress so you can achieve your long-term financial goals.

Need help?

Contact Us

Phone: (732) 203-7377

Email: [email protected]

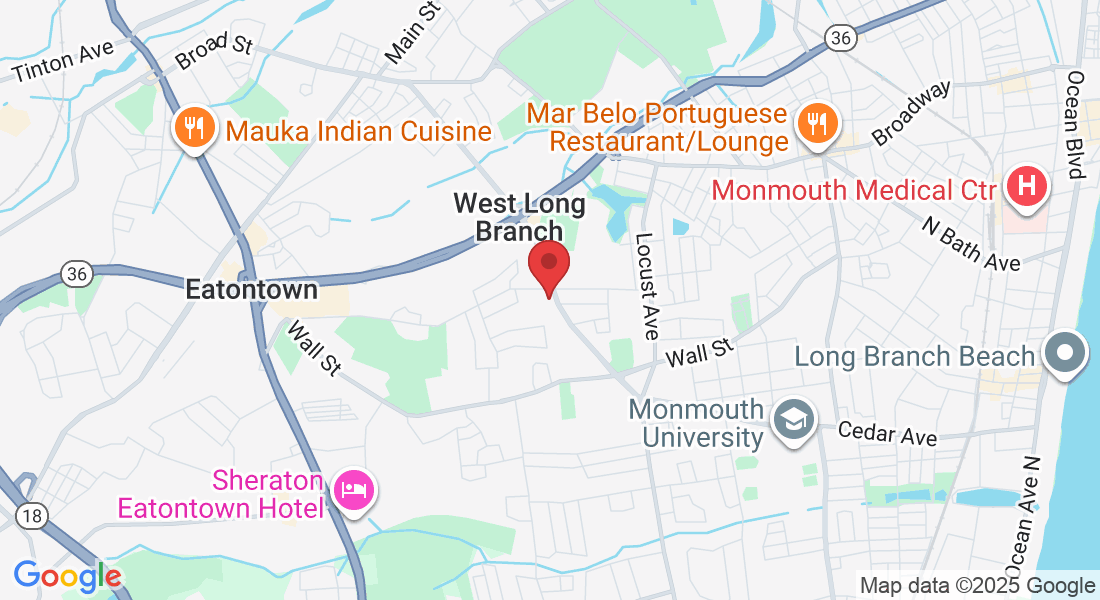

Office Address: 241 Monmouth Rd LL05, West Long Branch NJ 07764