Better Qualified

Business & Consumer Credit Experts

Consumer & Business Credit Repair Services

Take control of your credit and start your path to financial success today.

How Better Qualified Works

At Better Qualified, we start with a free credit consultation to evaluate your unique situation and identify the items negatively impacting your score. Our team then works directly with credit bureaus and creditors to challenge inaccurate, outdated, or unverifiable information—helping you rebuild and strengthen your credit over time. With personalized strategies and ongoing support, we guide you every step of the way toward better financial health.

Know Your Credit

Get your latest credit report and scores from all three credit bureaus to see what negative items are hurting your score

Join and pick a plan

Based on your credit situation, select a plan that suits and meets your financial needs

Await your results

Relax and let us do the job you've hired us to do--get you results. If we cannot get you positive results, we'll refund your money back!

How does Better Qualified help fix my credit?

Over the last 20 years, we have learned a lot about the credit repair process and those lessons have us fine-tuned and developed a proprietary 6-month intensive program that have proven to be quite effective, yielding incredible results, regardless of your credit situation.

Our Process Includes

Identify potential errors, inaccuracies, and outdated information on your credit report that may be unfairly lowering your score.

Dispute inaccurate or unfair reporting or inquiries on your accounts

Intervene and correspond with the credit bureaus, creditors, financial institutions, lien holders, government agencies, etc.

If required, engage with you on other interventions, including debt settlement, cease and desist orders, etc.

Identify

The first step in the credit repair process is to identify errors, inaccuracies, and misreported information that could be negatively impacting your credit score. Credit reports often contain outdated accounts, duplicate listings, or incorrect negative marks that lower your score unfairly. By carefully reviewing your credit report, you can pinpoint these issues and determine which items need to be addressed. This critical step sets the stage for disputing and removing inaccurate information, paving the way for a stronger financial future.

Dispute

After identifying errors or unfair negative items on your credit report, the next step is to dispute them with the credit bureaus and creditors. This involves formally challenging any inaccurate, outdated, or unverifiable information that may be dragging down your score. By submitting disputes with supporting evidence, you can push for the removal or correction of these items. Successfully disputing inaccurate reports can lead to significant improvements in your credit profile, bringing you one step closer to financial stability.

Intervene

Once disputes have been submitted, the next step is to intervene by actively corresponding with credit bureaus, creditors, and other financial institutions. This process involves following up on disputes, requesting further investigations, and ensuring that all parties comply with consumer protection laws. In some cases, it may require negotiating with creditors or working with government agencies to resolve outstanding issues. By taking a proactive approach, you can push for timely corrections and removals, helping to restore your creditworthiness.

Engage

In cases where additional action is needed, the final step is to engage in strategic interventions to protect and improve your financial standing. This may include negotiating debt settlements, issuing cease and desist orders to stop unfair collection practices, or working with legal and financial professionals to resolve complex issues. By taking decisive steps beyond disputes, you can address deeper financial challenges, regain control of your credit, and work toward long-term stability.

What is a credit freeze?

Also known as a security freeze, this free tool lets you restrict access to your credit report, which in turn makes it more difficult for identity thieves to open new accounts in your name. That’s because most creditors need to see your credit report before they approve a new account. If they can’t see your report, they may not extend the credit.

Does a credit freeze affect my credit score?

No. A credit freeze does not affect your credit score.

A credit freeze also does not:

- Prevent you from getting your free annual credit report

- Keep you from opening a new account, applying for a job, renting an apartment, or buying insurance. But if you’re doing any of these, you’ll need to lift the freeze temporarily, either for a specific time or for a specific party, say, a potential landlord or employer. It’s free to lift the freeze and free to place it again when you’re done accessing your credit.

- Prevent a thief from making charges to your existing accounts. You still need to monitor all bank, credit card and insurance statements for fraudulent transactions.

Does a credit freeze stop prescreened credit offers?

No. If you want to stop getting prescreened offers of credit, call 888-5OPTOUT (888-567-8688) or go online. The phone number and website are operated by the nationwide credit bureaus. You can opt out for five years or permanently. However, some companies send offers that are not based on prescreening, and your federal opt-out right will not stop those kinds of solicitations.

As you consider opting out, you should know that prescreened offers can provide many benefits, especially if you are in the market for a credit card or insurance. Prescreened offers can help you learn about what’s available, compare costs, and find the best product for your needs. Because you are pre-selected to receive the offer, you can be turned down only under limited circumstances. The terms of prescreened offers also may be more favorable than those that are available to the general public. In fact, some credit card or insurance products may be available only through prescreened offers.

Can anyone see my credit report if it is frozen?

Certain entities still will have access to it. Your report can be released to your existing creditors or to debt collectors acting on their behalf. Government agencies may have access in response to a court or administrative order, a subpoena, or a search warrant.

How do I place a freeze on my credit reports?

Contact each of the nationwide credit bureaus:

Equifax

Equifax.com/personal/credit-report-services

800-685-1111

Experian

Experian.com/help

888-EXPERIAN (888-397-3742)

Transunion

TransUnion.com/credit-help

888-909-8872

You’ll need to supply your name, address, date of birth, Social Security number and other personal information. After receiving your freeze request, each credit bureau will provide you with a unique PIN (personal identification number) or password. Keep the PIN or password in a safe place. You will need it if you choose to lift the freeze.

How do I lift a freeze?

A freeze remains in place until you ask the credit bureau to temporarily lift it or remove it altogether. If the request is made online or by phone, a credit bureau must lift a freeze within one hour. If the request is made by mail, then the bureau must lift the freeze no later than three business days after getting your request.

If you opt for a temporary lift because you are applying for credit or a job, and you can find out which credit bureau the business will contact for your file, you can save some time by lifting the freeze only at that particular credit bureau. Otherwise, you need to make the request with all three credit bureaus.

What’s the difference between a credit freeze and a fraud alert?

A credit freeze locks down your credit. A fraud alert allows creditors to get a copy of your credit report as long as they take steps to verify your identity. For example, if you provide a telephone number, the business must call you to verify whether you are the person making the credit request. Fraud alerts may be effective at stopping someone from opening new credit accounts in your name, but they may not prevent the misuse of your existing accounts. You still need to monitor all bank, credit card and insurance statements for fraudulent transactions.

Three types of fraud alerts are available:

Fraud Alert. If you’re concerned about identity theft, but haven’t yet become a victim, this fraud alert will protect your credit from unverified access for one year. You may want to place a fraud alert on your file if your wallet, Social Security card, or other personal, financial or account information is lost or stolen.

Extended Fraud Alert. For victims of identity theft, an extended fraud alert will protect your credit for seven years.

Active Duty Military Alert. For those in the military who want to protect their credit while deployed, this fraud alert lasts for one year and can be renewed for the length of your deployment. The credit bureaus will also take you off their marketing lists for pre-screened credit card offers for two years, unless you ask them not to.

To place a fraud alert on your credit reports, contact one of the nationwide credit bureaus. A fraud alert is free. The credit bureau you contact must tell the other two, and all three will place an alert on their versions of your report.

Consider Freezing Your Credit:

Freezing your credit is a proactive step to protect your financial identity. It prevents new creditors from accessing your credit report, making it more difficult for identity thieves to open accounts in your name. To place a freeze, you need to contact each of the three major credit bureaus separately or use a service like CreditKarma:

Please know, that freezing your credit does not affect your credit score nor prevents you from getting your free annual credit report. You can lift the freeze temporarily using a PIN if you need to apply for credit or permanently when it suits your needs.

TESTIMONIALS

What Our Clients Are Saying...

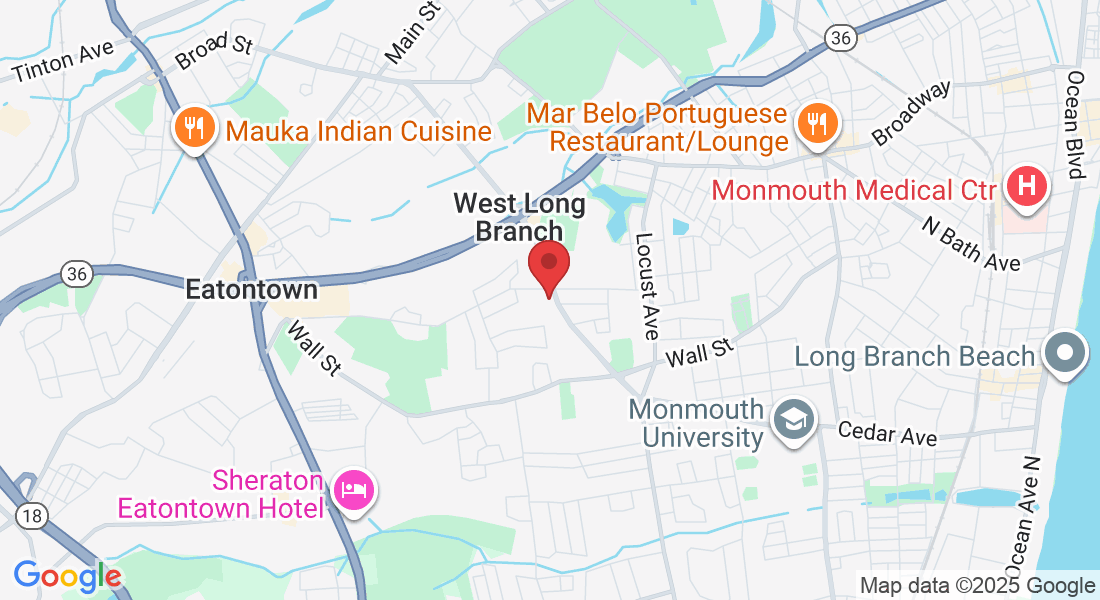

Contact Us

Phone: (732) 203-7377

Email: [email protected]

Office Address: 241 Monmouth Rd LL05, West Long Branch NJ 07764